Tim McDonald

Principal

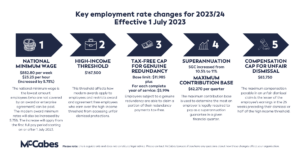

From 1 July 2023, a number of employment related thresholds increased for the 2023/2024 financial year. The cap on the amount of compensation available to an unfairly dismissed employee has increased from $81,000 to $83,750, with the high-income threshold having increased from $162,000 to $167,500. The filing fee for unfair dismissal, general protections and anti-bullying/sexual harassment at work applications made under sections 365, 372, 394, 773 and 789FC of the FWA has increased from $77.80 to $83.30. Other changes will also impact the national minimum wage, the tax-free cap for genuine redundancy and superannuation entitlements.

The key employment rate changes effective, as of 1 July 2023, are summarised as follows:

There is also an updated Fair Work Information Statement available on the Fair Work Ombudsman’s website reflecting the above changes. Please find a copy of the FY2023/24 Fair Work Information Statement here.

If you would like further information regarding any of the changes that have come into effect on 1 July 2023 and what it means for your business, please get in touch with the Employment group at McCabes Lawyers.